When you process a credit card payment, you’re paying for several things. Here’s the breakdown: Interchange Fees: These are the fees that go to the bank that issued your customer’s card. They vary depending on the card type (credit, debit, rewards, etc.) and the way the transaction is processed (in-person, online, keyed-in). Assessment Fees: TheseContinueContinue reading “How much should I be paying for credit card processing?”

Tag Archives: Basics

How Much is a Credit Card Reader? Spoiler Alert: It’s Not Just About the Price Tag!

So, you’re ready to take your business to the next level and start accepting credit card payments. You’ve got your eye on that sleek card reader, but one question keeps popping up: How much is this going to cost me? Well, hold on to your hats, because the answer might surprise you! The Price Tag—It’s Just theContinueContinue reading “How Much is a Credit Card Reader? Spoiler Alert: It’s Not Just About the Price Tag!”

What does a merchant service do?

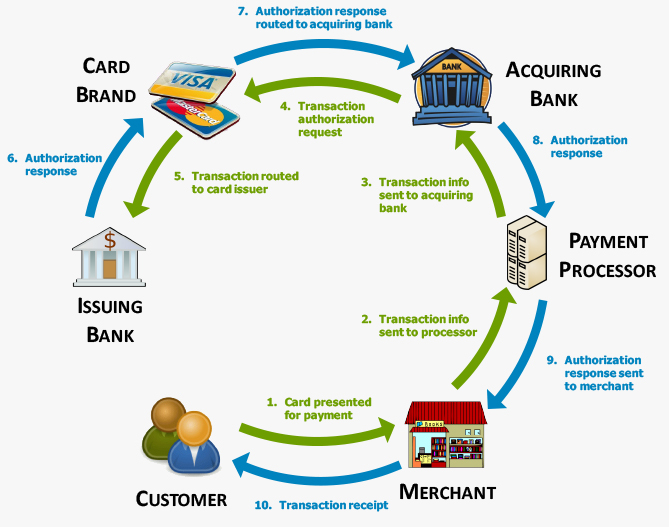

Welcome, curious minds! If you’ve ever wondered about the wizards behind the scenes who make your card transactions seamless, you’re in the right place. Today, we’re diving into the enchanting world of merchant services, shedding light on the magic that makes your purchases possible. So, grab your wands (or credit cards) as we embark onContinueContinue reading “What does a merchant service do?”

What is the average rate for credit card processing?

Hey there, savvy business owners! If you’re in the game of making money (and who isn’t?), you’ve probably danced with the idea of accepting credit card payments. But, before you dive into the financial tango, you’re likely wondering, “What is the average rate for credit card processing?” Well, buckle up because we’re about to demystifyContinueContinue reading “What is the average rate for credit card processing?”

Can I create my own payment gateway?

In the vast realm of e-commerce and digital transactions, the heartbeat of every business is its payment gateway. It’s the virtual pathway where money changes hands, making it a crucial component for any online enterprise. Understandably, entrepreneurs often ponder the possibility of creating their own payment gateway. The allure of autonomy and cost-efficiency is certainlyContinueContinue reading “Can I create my own payment gateway?”

Understanding Merchant Services for Small Businesses

In today’s digital age, small businesses need to adapt and embrace modern payment processing methods to thrive in a competitive market. Merchant services play a crucial role in facilitating these payment transactions. But what exactly are merchant services for small businesses, and how can they benefit your company? In this blog post, we’ll explore theContinueContinue reading “Understanding Merchant Services for Small Businesses”

What are card swipers called?

In today’s digital age, card swipers have become a ubiquitous tool for processing payments and transactions. Whether you’re making a purchase at a retail store, dining at a restaurant, or using public transportation, you’ve likely encountered these devices. But have you ever wondered what these card swipers are called? In this blog post, we’ll exploreContinueContinue reading “What are card swipers called?”

What falls under merchant services?

Hey there, savvy shoppers, enthusiastic entrepreneurs, and curious consumers! Today, we’re about to embark on a thrilling journey into the mystical world of “Merchant Services.” Ever wondered what exactly falls under this enigmatic umbrella term? Well, grab your magnifying glass and Sherlock Holmes’ hat because we’re about to uncover the secrets of this fascinating realm!ContinueContinue reading “What falls under merchant services?”

Can you pass credit card fees to consumers?

Yes, it is possible to pass credit card fees to consumers. In the United States, merchants have the right to charge customers a fee for using a credit card as a form of payment, as long as the fee is clearly disclosed to the customer and does not exceed the cost of processing the creditContinueContinue reading “Can you pass credit card fees to consumers?”

Quickbooks: Is It a Payment Processor?

The short answer is no. Quickbooks is not a payment processor. While it does have some payment processing capabilities, it’s not a full-fledged payment processor. Quickbooks is a popular accounting software used by businesses to manage their financials. It’s known for its user-friendly interface and wide range of features, including invoicing, expense tracking, and reporting.ContinueContinue reading “Quickbooks: Is It a Payment Processor?”